Reaching for a higher standard

St Lucia’s Citizenship by Investment (CBI) programme came later than others in the region. Initially, it operated at a deficit as the programme was established. In April 2022, Prime Minister Philip Pierre hailed CBI receipts of US$38 million during his annual Budget Address. In the face of European and US objections to the way the programmes risk being used to avoid taxation, launder money or even support terrorism, St Lucia’s former prime minister is urging all CBI programmes to be merged under the control of the Organisation of Eastern Caribbean States (OECS). Agents, politicians and the former head of St Lucia’s CBI Programme say there is a need to improve public awareness and transparency. They contend that ordinary citizens need to understand how CBI funds benefit them in helping to offset disasters, manage debt and brace for unexpected economic shocks.

*****

St Lucia was the last to join its sister islands in launching its own CBP. After years of watching the missteps and embarrassments of others pedalling passports to the wealthy, they took the plunge in 2015. Critics had pummelled the other OECS territories for their lack of transparency and accountability. How St Lucia tried to steer clear of that is worthy of closer consideration.

Did it have a choice? “Not really,” says former St Lucian prime minister and current Opposition Leader Allen Chastanet.

“Whether St Lucia had a CIP or not, it was in the CIP because we were a part of the Organisation of the Eastern Caribbean States (OECS) union and we had St Kitts (and Nevis), we had Antigua (and Barbuda), we had Dominica, we had Grenada, so for many years there were examples of persons coming from China who got citizenship in Dominica and by virtue of being a citizen in Dominica, had free access to our market, so in essence, we were already in the CIP programme. When we opened it, what we wanted to do was be different,” he explained.

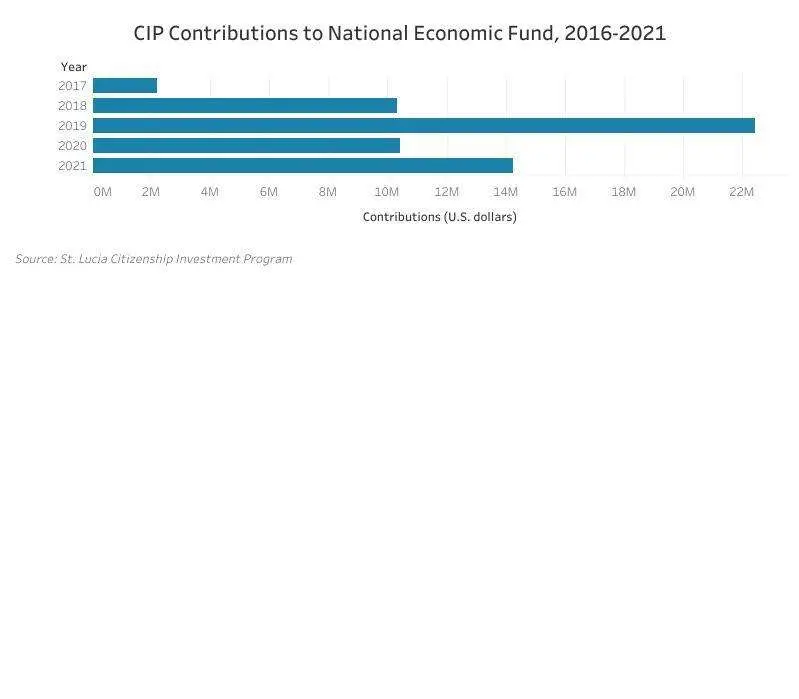

Well, not in everything it seems. PM Chastanet and his colleagues quickly learned that offering a simple path to economic citizenship for US$200,000 wouldn’t work. There was fierce competition in the field. Chastanet quickly slashed the single applicant entry price in half in 2017 to US$100,000. All in, St Lucia now offers one of the lowest-priced entry points of any CIP for single applicants who want a passport quickly with an outright donation to its National Economic Fund (NEF).

The price reduction worked for the island and the NEF donation grew in popularity as the preferred way to get a second passport in St Lucia.

By 2020-2021, 64 per cent of applicants were choosing to gain citizenship by investing in the NEFdirectly.

Other routes for investment include real estate or enterprise options. Applicants require a minimum investment of US$300,000 and US$3,500,000, respectively. Both these routes require a non-refundable administration fee of US$50,000.

Following the onset of the novel coronavirus pandemic, the island introduced a limited time offer of a special COVID-19 bond. The bond can be bought for $250,000 and while it requires a $30,000 service fee and $7500 for due diligence, the initial sum is fully refundable after five years. However, noteworthy is that these are non-interest bearing bonds. The COVID-19 bond offer was set to end on December 31, 2021, however due to the popularity of this option, the initiative was extended to December 2022.

In a Special Edition of the 2020-2021 annual report, the chairman of the Citizenship by Investment Board Ryan Devaux noted that the bond was a part of a diversification strategy. He said it “has been a valuable tool in ensuring that, as an island, we have continued to meet all our debt obligations and to be able to continue financing our recurrent expenditure, at a time when our tourism revenues have seen a significant negative impact.”

The table shows that despite the pandemic and economic downturn, St Lucia actually saw an increase in applications.

Like Citizenship by Investment schemes in the Caribbean, applicants are required to pay US$7,500 for due diligence; a four-layered fact-checking process aimed at ensuring those who are granted citizenship will not bring the country into disrepute. St Lucia’s stringent due diligence process is recognised internationally.

This process starts with the agents who are authorised by CIP to assist applicants with the process followed by investigations carried out by four highly established international private due diligence firms: Thomson Reuters, BDO Consulting, IPSA International, and Wealth X LLC.

Alana Eugene Dujon, who is the managing director of one of the first licensed agents for CIP: Century Capital Inc, pointed out that banks do the first round of checks. “If the bank does not clear the applicant when the funds come in, it is pointless for our firm to even accept the client to submit to the unit,” she explained.

At the top level of investigation is the Joint Regional Communications Centre (JRCC) based in Barbados. The JRCC scans incoming applicants. That is conducted by intelligence services from the United States, European Union and Canada.

Former Prime Minister Chastanet, who now heads the political opposition, stressed that if St Lucia wanted to be different, it needed to set a higher standard.

“This was a huge project, you’re playing with the citizenship and patrimony of our country and we had to take it very seriously,” former PM Chastanet told CIJN.

Russian and Belarusian applicants are no longer eligible as a result of the conflict in Ukraine.

Transparency and Accountability

St Lucia’s Citizenship by Investment programme publishes annual reports that detail the number of passports issued, countries or regions from which applicants originated and an accounting of funds.

The consistency of the reports and the broad range of data made available distinguish St Lucia’s transparency efforts. Uncommon is how programme expenses are detailed, giving insight into the costs incurred trying to develop the programme.

The publication of the Annual Citizenship by Investment reports makes that data available to citizens. All previous reports remain online and in 2022 St Lucia’s CIP published a “Special Report” with insights into how the programme had changed since inception.

The financial reporting is detailed. It includes a breakdown of fees earned through the various options of entering the programme and how those monies are spent to run the CIP. It also reports any excess of administrative fees (above expenses) that are transferred into the consolidated fund.

Importantly, St Lucia’s CIP Annual Reports include an assessment by an independent auditing firm.

Transparency Up to a Point

St Lucia started off by naming the persons who bought passports from the country along with the beneficiaries.

“Information contained in the annual report…shall include – the names, addresses and nationalities of successful applicants and any qualifying dependents included in the applications; the amount and other details of the investment; such other information as the minister considers appropriate.”

– Citizenship by Investment Act No 14 of 2015.

Partly as a result of the fierce competition with other CIP in the Caribbean, St Lucia adopted a policy of not reporting any names or other personal information beginning in 2019. The logic was that wealthy individuals wanting a second passport would select a CIP scheme that promised them privacy.

The former prime minister defended this strategy. When pressed, Chastanet invoked the justification used by others. “It is a matter of confidentiality,” he said.

Chastanet added that “publishing the names would’ve been very, very difficult and again, we don’t see that kind of precedent anywhere in the world.” He argued that the Government has fulfilled its obligations to its citizens and the 146 countries that St Lucia passport holders can enter visa-free by putting that strict due diligence process in place.

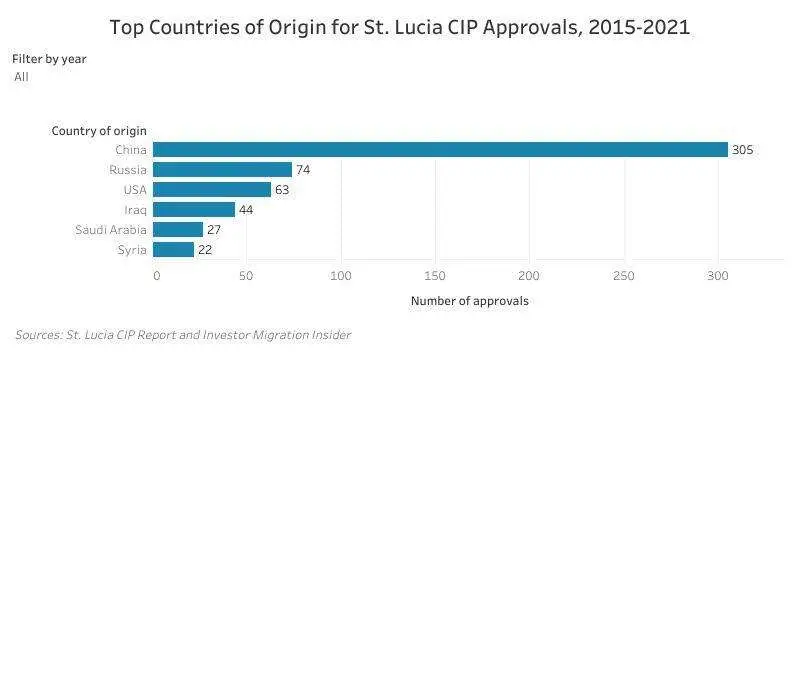

A check of the 2020- 2021 annual report shows the majority of applicants are Chinese nationals.

The large number of Chinese applicants may reflect this concern about confidentiality. Mainland China doesn’t recognise dual passports and if one of these applicants was “outed” it could jeopardise their Chinese nationality, any positions they may hold in the Communist Party and social entitlements. Hong Kong residents have enjoyed the possibility of dual citizenship in the past but that is changing. In January 2021, new laws made it possible for Hong Kong residents to own more than one passport but dual nationality is not recognized. There is no breakdown of Chinese applicants based on whether they reside in Hong Kong or the mainland. From an Asian perspective, wealthy Chinese business owners may view a second passport as the “Ultimate Luxury.”

Though the names are not published upon receipt of passports, a person who has their passport revoked for cause does face having their name published.

Despite its strict investigative processes, St Lucia’s CIP is not bulletproof. In the past, it has revoked the citizenship of at least seven passport holders.

The latest case occurred in December 2021 when the Minister responsible for the CIP Dr Ernest Hilaire revoked the citizenship of Nigerians, Boniface Amandianeze Odenigbo and Amandianeze Olasumbo Olawle, reporting that they committed acts that may bring Saint Lucia into disrepute. Nigeria Abroad as well as local outlets reported that Odenigbo and Olawle were arrested and charged for alleged Internet fraud and money laundering.

Was this a failure on the part of its supposedly strict due diligence process?

The former CEO of St Lucia’s CIP Nestor Alfred doesn’t think so.

In an interview with CIJN he said, “the issue here is that you can be a good guy at the time when you’re granted citizenship and when it comes to denial of an application, it must be on solid grounds…grounds that are within the confines of the legislation.” But he argued that after they’ve got a passport, some may willingly change course saying, “when you are given citizenship, you may find yourself in challenges.”

The former CEO said there is a system in place for continued monitoring of those granted citizenship and this is what uncovered the Nigerian case.

In 2018, the Citizenship by Investment Unit also cancelled six passports obtained through the programme.

The St Lucian Government maintains the right to revoke the citizenship of those convicted of serious wrongdoing or giving false information.

Preparing for Emergencies

Former Prime Minister Chastanet said the profits from the fund were intended to buffer St. Lucia from external shocks.

“So what we felt and I still believe that very much so right now, that because of the exogenous shocks that are coming fast and furious, 9/11, the recession in the mid 2000s, climate change, the pandemic and now what is taking place with the Ukraine war and the supply chain issues, we as small island developing states are always going to be exposed to them,” he explained.

According to Chastanet, the country could not afford to borrow money to cushion the effects of external shocks as this would lead to a spiral of debt.

“So, the goal was to create a wealth fund that can act as a source of money in times of catastrophe, more importantly, raise the wealth profile of our country, and certainly monies that can either be used to buy bonds or invest in critical aspects of this country,” he explained.

For the first two years of the programme, he said the monies were placed in the consolidated fund and helped in turning around “a budget deficit that had been running for almost 15 years.”

After addressing the budget, he told CIJN that funds were used to meet the challenges posed by climate change. He cited things like the replacement of a roof of the Colonial Development Corporation (CDC) buildings blown off during a July 2021 hurricane. As a result of the storm, farmers were also compensated from CBI funds for the destruction of their banana crops.

Chastanet added that “in the initial phases, many St Lucians wouldn’t have necessarily felt it directly, but we benefited because our credit rating was improving, and the [Government] was now feeling confident that there was a reserve of money that was available to us.”

It took years to turn things around. In its 2020-2021 Annual report, which provided a five-year review, it was highlighted that St. Lucia’s CIP administrative fees from bonds and real estate were beginning to not only cover expenses, but earn profits that could be transferred to the consolidated fund.

The Real Estate Option

Like any other Caribbean nation, St Lucia is looking to enhance its biggest income earner, the Tourism Industry. Approved real estate projects aim to do just that.

In the 2020-2021 Special Report, it was disclosed that a hotel and a resort are open for investments. For the reporting year, there were 75 applications through the real estate option from persons willing to invest this way.

St Lucia’s inexperience in dealing with agents and developers caused early problems. One hotel resort project was abandoned after the developers decided their money would be better spent with more experienced administrators.

In 2022, there are only two approved real estate projects in St Lucia. The St Lucia Canelles Resort had a magnificent groundbreaking but two years later not a brick has been laid.

Citizenship applicants are required to invest US$300,000 to buy into the Canelles project that will include beachfront apartments, bars, swimming pools and clubs.

Meantime, the Alpina St Lucia Hotel and Alpina Square development is officially approved as a Citizenship by Investment opportunity but it remains stalled.

Why Does Citizenship by Investment Matter?

Some of the major contributions of the CBI programme are literally invisible to St Lucian citizens. Drawing down the nation’s debt is an important achievement, but it doesn’t build any monuments or boardwalks. The former CEO of the programme says more public awareness is needed.

Nestor Alfred observed there’s no real discussion of what the programme does. He thinks the government should be providing information and statistics, becoming more transparent to ordinary citizens.

Alfred says it’s an issue all across the region, especially in countries where CIP makes up, up to 60 per cent of their GDP. In St Lucia, the audit reports show that fees earned from the CIP for the first four years were expended on initiating the programme.

“Some of those countries, when you go into those islands and the ordinary man, the taxi drivers, you ask him what CIP means to you. More likely than not, (he says), I really don’t know what this is all about. So there has to be a greater level of transparency surrounding the programmes.”

The lack of public awareness leaves some applicants feeling left out even after being vetted and handed their passports.

According to CIP agent Dujon, “the St Lucian public, the institutions have not, in my opinion, embraced [that] we have a programme and these individuals are now St Lucians.”

Dujon lamented the fact that CIP passport holders were unable to even open a bank account or get a national identification card in St Lucia. She said that has to change if the program is to be truly successful.

The Future of Citizenship By Investment

Recently, the European Union warned Caribbean countries to end their Citizenship by Investment Programmes or risk visa restrictions. The countries that could be lost are the 26 EU nations that are included in the Schengen area. St Lucia and other CIP nations enjoy visa-free travel to these countries. Citizenship by Investment specialists views EU access as “a crown jewel” of any CIP programme.

To solve Europe’s concerns, former St Lucian Prime Minister Allen Chastanet believes all of the region’s CIP programmes should be placed in the hands of the Organisation of Eastern Caribbean States.

Chastanet told the CIJN that essentially Europe is less suspicious of the CIP Programmes than it is of the politicians running them. Removing politicians as far as possible from the everyday functioning of the programmes would reduce those suspicions and fears.

It could also improve accountability in the way CBI funds are spent.

“By putting it in the regional body in which everybody is benefitting and there is a proper accounting of all the money that’s coming in, people will see that those monies are going towards improving resilience for climate change in our region, improving education, improving health care,” said Chastanet.

His views were mirrored by former CEO of the Citizenship by Investment Unit, Nestor Alfred said there is too much politics even in who should lead the programmes and the process needs to be more transparent.

“One of the glaring issues or challenges with the CIP programmes in this region is that it is too politicised.”

In his view, people are being employed based on their political affiliations as opposed to their expertise in the areas of accounting or business development.

After losing his own job due to a political shift, Alfred has now joined one of the biggest CIP brokers in the world. He is now a director of the board at Europe-based Migronis. Migronis, headquartered in Portugal, helps to obtain citizenship and residency by investment in 20+ countries around the world.

At the end of April 2022, a senior official of the International Monetary Fund (IMF) warned Caribbean countries operating Citizenship by Investment Programmes to get their act together. Noting how important these funds were to many Governments, Ilan Goldfajn said the five Caribbean countries need to work in close collaboration with Europe and the United States.

The above article was published at the request of the Caribbean Investigative Journalism Network.