Ex-NCB worker pleads for meeting with Lee-Chin

MONTEGO BAY, St James — Claiming she was forced to resign after 15 years due to health issues, a former National Commercial Bank (NCB) insurance advisor is appealing to meet with the bank’s Executive Chairman Michael Lee-Chin.

The 57-year-old former worker, who asked not to be named, told the Jamaica Observer that her plight started in 2019 and would last until July 2022 when she eventually took early retirement from the bank. She explained that while at work one morning, she felt “a heavy pulling in my head that had me crouching”.

Taking the advice to have her blood pressure checked, the former worker said she immediately went to the doctor where she was told that her blood pressure “was through the roof”. She was subsequently told that an MRI was needed, which showed several tumours on her brain, the former insurance advisor told the Sunday Observer.

“I found Dr Carl Bruce who told me I needed brain surgery quickly. I had the procedure, and the largest tumour on the right was removed. Coming up to three months after the first surgery [I] needed a second surgery to remove a tumour on the left side. Dr Bruce had to remove two tumours so three were removed in all. The frontal lobe had a tumour,” she said.

Pointing out that the frontal lobe controls an individual’s emotions, the woman stated that her recovery from surgery caused major emotional stress.

“There are adjustments after major surgeries — post-traumatic stress disorder, the frontal lobe controls the emotions so simple utterances would disturb me, light sensitivity in the left eye so I could not drive,” she said.

The former insurance advisor said that she was eventually placed on six months’ sick leave but would still interact with clients and refer business to the bank. After returning to work she told the Sunday Observer that she enquired about medical redundancy, however, she did not qualify.

Her next move, the former NCB worker said, was to request that she be removed from front line duties as the emotional stress coupled with the novel coronavirus pandemic were proving to be too much.

“I wrote a letter asking to be transferred from the insurance sales team but nothing came of it. I sent other emails, called senior management, and applied for a post — but to no avail. I submitted a medical letter from Dr Bruce but, to no avail. Staff saw my distress, crying, walking the road, pulling away, but no change came,” she bemoaned.

The former insurance advisor explained that she would become distressed whenever her customers were unhappy and would have to take walks to gather herself. That, she said, would eventually lead to her resignation.

“Once the customer is unhappy, I am unhappy. Sometimes when I got emotional I would just leave the Half-Way-Tree branch, walk to Old Hope Road, and come back down. When I was at the UWI branch I did the same thing — I would just circle the Ring Road and come back in. I kept asking them to take me off the front line. I have never been called into a meeting to address my situation. It was just a hard time,” she told the Sunday Observer.

The former NCB worker added, “I resigned because I couldn’t manage emotionally. The place was just not where it was. When I saw the mayhem around me I kept saying to management that things were not working out because the customers’ affairs were not where they were supposed to be.”

“A very bigwig customer said that he was going to go on social media and nobody would want to do business with us when he is finished. I had to run around the block to get his affairs sorted out. I value customers, and once I see the customer I want to see what I can do for them. That is just how I am programmed,” she added.

The woman said that life got extremely hard after walking away from her job. She fell on hard times, which forced her to sell her home and a car because she could no longer afford to keep them in her possession. In addition, she said that she has been finding it difficult to pay her monthly bills and has had her electricity disconnected on numerous occasions over the past year.

Seeking a new job was also very hard, as the former NCB worker said that she has been turned down by many insurance companies.

“I tried to find ways to earn an income but I was connected to the wrong people, and that started suicidal stress. I had to sell major assets to relieve a financial debacle as I could not service them,” she said.

She added, “Plus, my medical history cannot be hidden. One recruiter asked me if NCB could not have put me somewhere else that is not as aggressive as sales. She even asked why she would employ an NCB person who went on early retirement.”

The former worker said she is hoping to speak with Lee-Chin in the hope of becoming reinstated in another position at NCB.

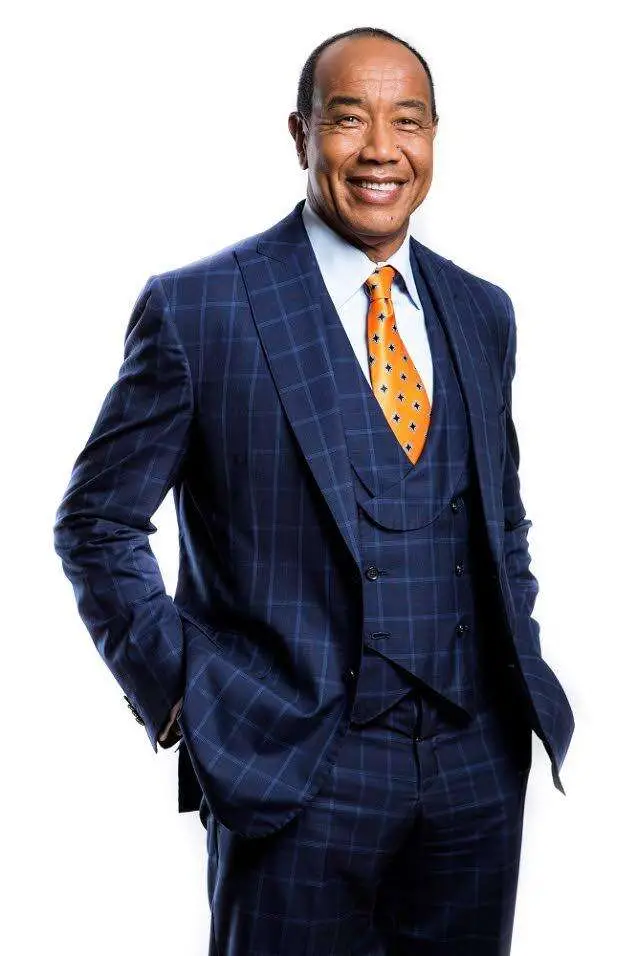

“I was told to repeat that ‘I’m a salesperson, not a service person’ so I find it most heart-rending to hear Mr Michael Lee-Chin lament about service, and that was what I was born to do. I would bring issues to management but no one listened. I was greeted by the former general manager as ‘Hi, complainer.’ Mr Lee-Chin, I need an audience with you,” she appealed.