BOJ FX interventions spike in July

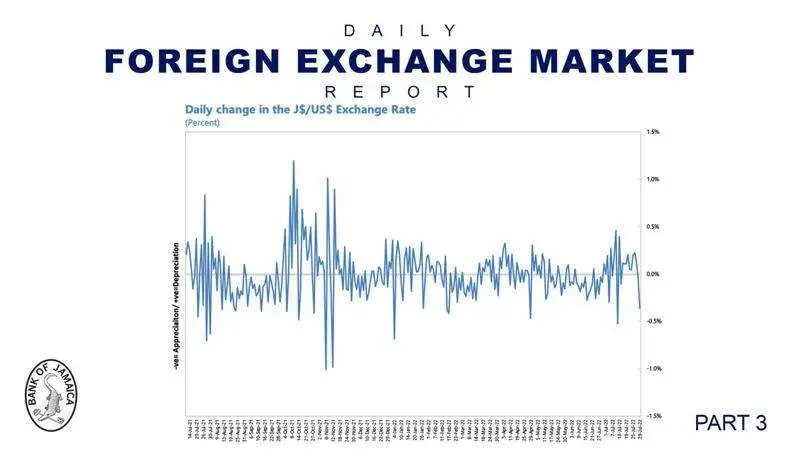

While the foreign exchange (FX) rate between the Jamaican dollar (JMD) and United States dollar (USD) has trekked up in the last month, the Bank of Jamaica (BOJ) has increased its interventions in the market through its BOJ Foreign Exchange Intervention Trading Tool (B-FXITT).

The BOJ deployed US$60 million between July 12 to 14, but only allocated US$56.10 million after some bids were above the highest reserve price and below the lowest reserve price which nullified them from allocation. Each day had demand exceeding twice the US$20 million which was on offer. National Commercial Bank Jamaica Limited (NCBJ) and JMMB Bank (Jamaica) Limited were allocated around US$8 million in the first two days as the most successful applicants with JN Bank Limited and the Bank of Nova Scotia (Jamaica) Limited (BNSJ) receiving between US$3.25 – US$4 million each on July 14. The settlement price for successful bids was between $150.00 to $151.93 on those days.

However, the BOJ returned to the market on July 28 and July 29 with US$30 million and US$40 million operation amounts, respectively. The offer on July 28 was fully allocated with a settlement price of $153.13 with US$60.50 million over 41 bids. The offer on July 29 was fully allocated with a settlement price of $153.15 with US$55.85 million over 36 bids. Both bids were settled a business day after the operation.

The US$40 million is the highest operation amount the BOJ has placed since February after the weighted average selling FX rate trended downwards from $155.08 to $153.78 in the first quarter and $151.56 by the end of the second quarter. The weighted average selling FX rate increased to $153.64 while the weighted average buying rate was $152.55 at the end of trading on July 29.

B-FXITT is a rules-based competitive multiple-price FX tool used to improve the BOJ’s interaction with authorised dealers (ads) and cambios for buying and selling foreign exchange. Operations take the form of the Flash Intervention Tool (FIT) and reflect a fixed volume format where eligible bids or offers are accepted on a best price principle. The deployment of the FIT takes place at the discretion of the BOJ depending on market conditions. The FX purchased can only be resold at a maximum spread of $0.20 to end-users which the BOJ defines as non-financial commercial client entities that are funding obligations for essential goods and services. The minimum bid size is US$100,000 with bids rounded to the nearest US$25,000 with each entity allowed to submit three bids during the operation.

The BOJ had not intervened in the FX market since May 12 and 13 which were the only interventions for the entire second quarter. The BOJ had B-FXITT operations on March 29 and 30 which came after it put a six-month moratorium on securities dealers through the Financial Services Commission on the issuance of FX instruments on February 22. While the BOJ amended it nearly two weeks later to issue FX instruments, the dealer had to prove that their distribution strategy would not create FX demand in the market, list all the intended sources of capital across the various client buckets and verification of the sources for the subscription once the offer is closed. This is set to end around August 22 unless the BOJ decides to extend the restriction.

The BOJ had put in the restriction after it deployed US$140 million through B-FXITT over February 14 to 17 and hiked its policy rate by 1.50 per cent on February 18. The BOJ had FX interventions six other times or nearly every week in January with its intervention in the first quarter well exceeding the US$205.30 million done in the final quarter of 2021. The BOJ also used FX swaps between January 28 to March 25 before discontinuing the tool on March 30. The FX Swap Arrangement was implemented in January 2020 to provide much needed USD liquidity to authorised dealers to promote and encourage forward market transactions. The country’s net international reserves moved up from US$3.76 billion to US$3.80 billion from May to June and represented 25 weeks of goods and service imports.

“This appreciation in May 2022 was mainly underpinned by US dollar liquidity support from the BOJ via B-FXITT and PSE sales of US$60 million and US$67 million, respectively. The appreciation in May was also influenced by a reduction in end-user sales during that month. In May, there was an increase in FX NOPs [net open positions] due primarily to net spot purchases, which outweighed forward sales during the month. The MPC expressed its satisfaction with the stability of the foreign exchange market but stressed the importance of adjusting interest rates upwards to restrain demand and curb inflation further,” stated the BOJ’s monetary policy committee meeting minutes for June 28 and 29 on the FX market and rate.