Caymanas Park fights off closure as it awaits divestment

BY BALFORD HENRY

Observer Senior Reporter

THE current financial state of Caymanas Track Limited (CTL) has redirected attention to the slow process of divestment of selected government properties under its Master Rationalisation Plan (MRP).

Information gleaned from a submission to Parliament’s Public Administration and Appropriations Committee (PAAC) recently by the Development Bank of Jamaica (DBJ), shows that the programme has hit a major snag since the sale of six sugar factories under the previous Administration.

Following the divestment of Duckenfield, Hampden/Long Pond, Frome, Moneymusk, and Bernard Lodge sugar factories, between July 2009 and July 2010, for a total of US$11 million, there has been very little action in terms of the other properties listed under the programme — the Wallenford Coffee Company (WCC), the Jamaica Railway Corporation (JRC) aerodromes at Boscobel (Ian Fleming International), St Margaret’s Bay (Ken Jones) and Negril, and CTL.

There is, at least, a proposed buyer for Wallenford, with Portland Private Equity (PPE) and AIC Caribbean Fund expressing an interest. An MOU being sought between PPE and the DBJ on behalf of the Government is still awaiting Cabinet approval.

No proposed buyer has been identified for ether the JRC or the three aerodromes, although some assessment and pre-qualification work has been started

However, the most immediate problem is CTL, which operates horse racing at Caymanas Park, St Catherine, which has been threatened with closure for several weeks now.

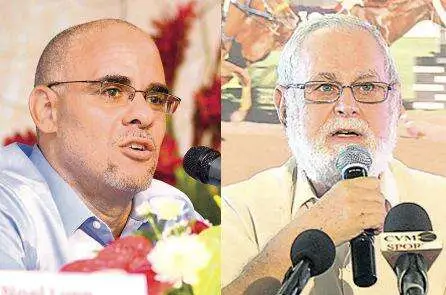

The situation has worsened so badly that CTL Chairman Joseph A Matalon, called a press conference at the track on March 19 to declare that the company was in a “dire position”.

“The board, in the absence of financial support from the consolidated fund (budget), is faced with challenges to keep the racetrack open during the divestment phase and prevent closure of horse racing in Jamaica,” Matalon said.

He explained that, in order to avoid this, his board had decided on some initiatives to avert a crisis and restore stability to the operations. However, some of the measures he is implementing has stirred concerns among the stakeholders, including some who are part of a wide alliance of owners, trainers and bookmakers, who have teamed with popular owner Michael “Michros” Bernard to form the Racing Divestment Committee (RDC), which is seeking to lease the track with an option to purchase down the road.

CTL currently owes the stakeholders approximately $53 million in purse money, which has not been paid for several months. However, the chairman said that the company plans to pay $21 million of the amount immediately and the rest in tranches between April and May, at which time he hopes that the payments will be regularised.

Matalon is convinced that a major contributor to the current losses at the track was an increase in purses awarded by the previous management in October, 2009.

“Despite an operating loss of $68 million in 2008, the board decided to increase the purses by 24 per cent or $110 million and a 30 per cent increase in appearance fees. The operating losses increased in 2012 to $147 million, and the building and infrastructure were not maintained and have deteriorated significantly,” he told the press conference.

He announced a reduction in purse monies and suspension of the bonus paid to the horse breeders which, he claimed, were necessary for the track to remain open.

All events with purses of over $3 million have been arbitrarily cut, and any sponsorship derived from each such race is to be shared between CTL operations and the reduced purses.

Matalon said he expects that the savings over the next 12 months from the purse adjustments will amount to some $74 million. However, he admitted that with the current financial structure offering a gross profit of only eight per cent, which is inadequate to cover operating costs, the track is expected to continue with its losses.

He admitted that the CTL situation worsened in 2012 as gross profit declined to $336 million, or 8.5 per cent of sales and operating losses stood at $149 million. To break even last year, CTL would have needed to increase revenues by $1.7 billion in actual sales of $4.3 billion.

Indications are that unless the government is able to dispose of the operations to a private entity capable of making the kind of investments necessary to turn around CTL’s fortunes, the future of the local horse racing industry, which feeds thousands of Jamaicans both directly and indirectly ranging from horse breeders, jockeys and trainers to betting shop attendants, “touts” and programmes vendors, could screech to a halt some time this summer.

The question is why is the divestment of the company proceeding so slowly?

In December last year, the Cabinet approved an enterprise team appointed by the Government to handle the divestment of CTL, with the head of the Sagicor Group, Richard Byles, as chairman. However, Byles eventually turned down the appointment after a conflict of interest developed as one of the parties in Bernard’s takeover bid team is being financially supported by Sagicor Investments.

Byles’ office told Caribbean Business Report on Wednesday that, in his best corporate judgment, he took the decision to turn down the Cabinet appointment which, he admitted, would have been a conflict of interest.

In the meantime, the CEO of the JMMB Group, Keith Duncan, has been declared his likely successor, although the Ministry of Finance and Planning has confirmed that the cabinet has not yet approved appointment of a new chairman.

The Enterprise Team, which currently consists of eight members including CTL Chairman Matalon; chairman of the Jamaica Racing Commission (JRC), Linton Walters; Mayberry Investments CEO, Gary Peart; attorney-at-law Walter Scott, and accountant Lloyd Duncan, seems ready to proceed as soon as Duncan is confirmed.