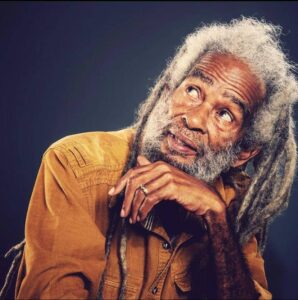

The resurgence of Michael Lee Chin – Part II

AIC mutual fund boss and chairman of NCB Michael Lee Chin has remained steadfast in adhering to his business mantra “Buy, Hold and Prosper”, and it has paid off big time for him.

Last week, Caribbean Business Report brought attention to the fact that the AIC Advantage Fund is up 70 per cent from March 2009 and a number of businesses in its portfolio are putting in creditable performances — the big man appears to have turned a corner and is proving the naysayers wrong.

Speaking to Canada’s Financial Post, Tim Cestnick, president and CEO of Burlington, Ontario-based Water Street Family Wealth Counsel said of Lee Chin: “He’s got a lot of experience when it comes to investing in not only publicly traded securities, but also private businesses. Michael is a true businessman and a very smart entrepreneur. Even today, he sees opportunities everywhere. That’s just the way he’s wired.”

Lee Chin concedes that perhaps he was too heavily positioned in the financial sector. Last week he said: “When the crisis hit (2007-08) there was too much of a correlation between the various arms. Although wealth management is our core business and what we know and do best, I had to find a way to reduce portfolio volatility. Today, 67.4 per cent of the AIC Advantage Fund is in financial services and its counter-cyclical holdings have grown to 30.4 per cent. It became imperative that I found areas where there was no co-relation.”

In keeping with Lee Chin’s philosophy of sticking with what you know and focusing on a few well managed businesses, the AIC Advantage Fund holds stock in just 18 firms where traditionally many mutual funds hold stock in as many as 100 companies. The breakdown is as follows:

In Jamaica, Lee Chin has holdings in banking, insurance, real estate, hotels, medical facilities, media, telecommunications and ports, making him the single largest investor in that country’s business community, and all this in less than a decade.

Speaking with Caribbean Business Report, Lee Chin said: “While it is important to diversify, one should not overdiversify. Wealth management still remains at the core of our portfolio.”

Focus on mutual fund companies, not mutual funds

The AIC boss went on to add that the key is not to concentrate on mutual funds but to invest in mutual fund companies. He drew attention to the fact that Canadian wealth managers have outperformed their own mutual funds. For example, if one invested Cdn$10,000 in CI Fund Management Inc from December 31,1994 to March 31, 2010 it would yield Cdn$230,002. That same Cdn$10,000 if invested in CI Canadian Investment units would result in a payout of Cdn$47,205 and the same sum placed in CI Global over the same 16-year period would produce Cdn$14,988.

Money managers Franklin Resources and Eaton Vance were two of the top three best-performing investments over the last 25 years. USA Today on August 3, 2007 noted that if an investor bought Franklin Resources, he or she would be up 64,224 per cent and Eaton Vance, 38,444 per cent.

To underscore his point, Lee Chin referred to Barry Rehfeld’s article in the New York Times of July 15, 2007 which read: ” Investors in the market for mutual funds may want to consider a promising alternative: shares of asset management companies that sell the funds. Over the long run, after all, these companies have produced much better returns than mutual funds overall.”

In other words the funds are good. The fund companies are better. According to Lee Chin, much of the money management firms’ allure is in their business model, which returns in good years and bad.

“I have always maintained that it is important to find someone who is experienced in investing and holding for the long run. When stock prices go down that’s the time to buy more stock and hold them,” said Lee Chin.

Looking to India

He has expressed an interest in the emerging economy that is India, which over the last few years has been growing at around 8 per cent per annum. Today 25 per cent of his AIC portfolio is in India.

“Our interest in Kingston Wharves gave us a degree of experience in port management. We took a look at Mundra in India, its port and a Special Economic Zone (SEZ). We realised that we could get the port at a reasonable price and with it land the size of Boston (United States) for free.

Mundra, once a town of 15,000, dependent on fishing, is expected to handle 100 million tonnes of cargo by 2013. The port has 45 kilometres of shoreline and the goal is for Mundra to have a population of 1 million in ten years.

“We put an order in of US$140 million to buy shares in Mundra. The issue was 140 times oversubscribed. Everyone got 140th of what they ordered, so instead of getting 140 million we got 1 million (it was prorated). We paid 440 rupees per share, and in November 2007 the share price went up to 1,400 rupees per share. The year 2008 saw the global recession, but India continued to grow at 8 per cent but fell back to 6.5 per cent in 2009. Many westerners sold their stock to meet margin calls and this saw the Mundra stock fall from 1,400 rupees per share to 250 rupees per share in March 2009. That month we paid 250 rupees per share for a substantial block of Mundra shares. Last week Mundra closed at 770 rupees per share. Mundra’s land when we invested cost 35 rupees per square metre; now it is selling at 13,000 rupees per square metre.

“That’s ‘Buy, Hold and Prosper’ at work for you. I am proud to say that Mundra is now 10.2 per cent of the fund with no correlation with our core business and so helps to dampen volatility. Today, the three largest shareholders in Mundra Port and Special Economic Zone are the Adani Family with 80 per cent, the Life Insurance Company of India and the AIC Advantage Fund.”

India is paying off handsomely for Lee Chin and he regards it as a major investment province for the future.

In 2002, Lee Chin acquired NCB and was faced with the onerous task of changing out the bank’s IT infrastructure. He hired PriceWaterhouseCoopers (PWC) to advise on the best way to go about this. They in turn reported that it would take NCB five years to do so, by which time Lee Chin opined that NCB would possibly go bankrupt. So he went out looking for vendors and found Infosys Technologies Limited of India. They changed NCB’s IT infrastructure in six months.

Infosys Technologies was started in 1981 by 7 people in India with US$250. It has focused on quality and innovation to leverage the improved global telecommunications infrastructure and India’s large, young and educated population to become one of the premier global IT services firms. Infosys has revenues of over US44 billion and a market cap exceeding US$25 billion.

“I studied this company and back in 2002 it had 13,000 engineers earning around US$12,000 a year. Now that same engineer would be earning around US$100,000 in the United States. After seeing what this company could do we bought shares in it in 2002. Today, it has 109,000 engineers and is the second largest beneficiary of outsourcing to India and its stock price has shot up,” said Lee Chin.

Foreign currency exposure

AIC Advantage Fund’s foreign currency exposure is a worthwhile indicator of Lee Chin’s strategy. As much as 55 per cent is in Canadian dollars, 24 per cent in Indian rupees and 21 per cent in US dollars. As at March 31, 2010, approximately 45 per cent of the fund’s holdings are in foreign currency securities. At the current exchange rates, hedges are in place for approximately 7 per of the US dollar exposure, leaving the net US dollar exposure at approximately 14 per cent. It does not currently hedge the Indian Rupee exposure as its outlook for that emerging market is positive.

Investing in Jamaica

As far as his homeland, Jamaica is concerned, the mercurial money manager has put his money where his mouth is. In less than ten years he has become the largest investor in Jamaica with a wide range of business interests.

“I am extremely proud to be a Jamaican and sell the country every opportunity I get. Jamaica is a great place to invest in. Yes, we do have our problems and perhaps we are not dealing with them fast enough but we are dealing with them,” said Lee Chin.

NCB

In 2002 he bought a 75 per cent stake in a beleaguered NCB for J$6 billion (US$127 million). Today it is reporting profits of above J$10 billion annually. Last Friday saw NCB reporting net profits of J$2.55 billion over the second quarter ending March 31,2010, a 14 per cent increase over the comparative period last year. During the period under review, NCB’s total operating income increased by 7 per cent to J$7.1 billion. Net interest income for the quarter was J$5.1 billion, up by 9 per cent over the corresponding period in 2009. Net fee and commission income increased marginally to J$1.4 billion. NCB’s Earnings Per Share (EPS) was J$1.03, compared to J$0.91 last year, while the Return on Equity (ROE) was 23.5 per cent.

“NCB’s results show that notwithstanding the significant challenges, difficulties and implementation of the various initiatives (most notably the JDX) which would have had a significant impact on our operations, we were able to produce strong and robust financial results,” said NCB Group’s Managing Director Patrick Hylton at a press conference held at the Group’s Kingston headquarters.

Commenting on NCB’s performance since he acquired a majority holding, Lee Chin said: “I am extremely proud of NCB. Back in 2002 it certainly was not the case that we were running neck and neck with Bank of Nova Scotia (BNS). Today, however, it is a different story and NCB stands as a role model for what indigenous people can do. The bank is headed by Jamaicans and is one of the few banks in the world that, over the last year, has grown its earnings and did not need an injection of capital. Even with the JDX, it has turned in a great performance and Patrick (Hylton), Dennis (Cohen) and the team have done a great job.”

Lee Chin who also has a stake in Columbus Telecommunications which operates as Flow in Jamaica took the opportunity to declare that he is not selling Flow and will be looking to extend its footprint both in Jamaica and across the region.

Flow

“Last year, Columbus raised US$450 million on the bond market. We are making capital expenditures and it is paying off. We will not be selling our interest in Flow. Right now Columbus has 16,000 kilometres of fibre optic cable under the sea and it serves many countries across the Caribbean and in Central America. Flow enjoys a presence in Jamaica, Trinidad, Curacao and Grenada and we are looking out for more opportunities.

“We brought the cost of telecommunications down by 84 per cent in Jamaica. Before we came on the scene it was one of the highest in the world and at the same time we managed to spawn the cost-effective call centre business in the country.”

Keeping bondholders happy

Late last year saw a number of local bondholders attempting to hold Lee Chin’s feet to the fire and pressure him to make good on US$150 million worth of AIC (Barbados) bond notes. He had managed before to buy some time from them but now they were getting restless.

Reflecting on those troubling times, Lee Chin said: “Well, they should be happy now. We have paid out US$40 million of that US$150 million and the payments to the bondholders continue in a timely fashion. Come to think of it, they are getting a good rate of interest with great collateral. Why shouldn’t they be happy?”

The man from Portland

Lee Chin is committed to revitalising his home parish of Portland and to this end has made a number of investments there. Last year saw him ceasing development of the Trident Hotel, but that project and a few others in the area will be resumed.

“The architect Marvin Goodman has met with the trades people to ascertain their needs and how soon the Trident project can be completed. He has presented me with a report which I have examined. We can now complete the purchase of one of Port Antonio’s leading landmarks, Trident Castle, and we will resume work on Trident Hotel by the middle of this year and expect to complete it by March 2011.

“We will lease the Blue Lagoon to John Baker who operates Gee Jam Hotel in Port Antonio. He has done a fantastic job with that project and will do wonders with the Blue Lagoon. We will be looking to run a restaurant there and John Baker has some fantastic ideas for the place,” said Lee Chin in giving an update of projects in his hometown.